Rate Citibank Customer Service!

Tell people what you think. Help others by sharing your experience with Citibank

[modalsurvey id=”408059976″ style=”flat”]

Citibank Australia Phone Number Overview

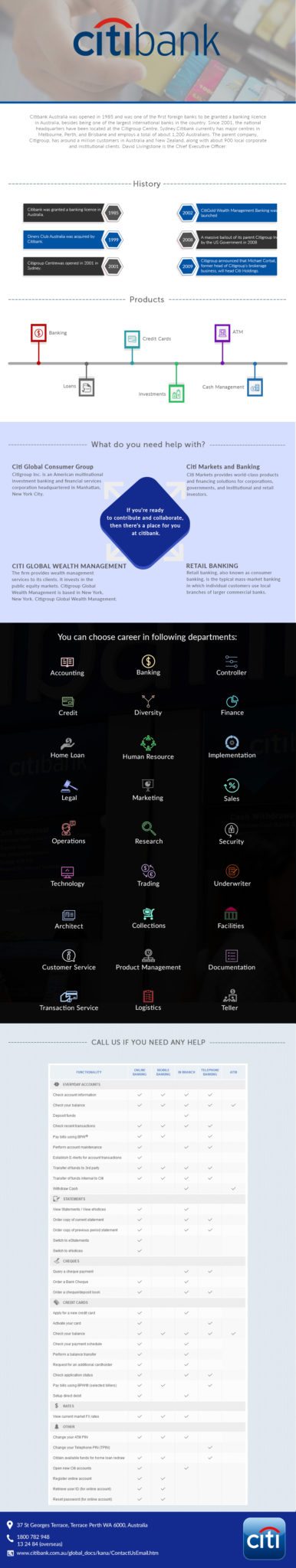

Being one of the first foreign banks to be granted a licence to operate in Australia Citibank commenced operations in 1985.

Citibank Australia’s headquarters is located at the Citigroup Centre, Sydney. Citigroup Centre, opened in 2001, is currently the 10th tallest building in Australia. It stands at 243 metres.

Citibank Australia is part of Citigroup, one of the biggest investment banking and financial services firms. Citigroup, a multinational company with a strong presence the world over, is one of the world’s largest financial services companies. In fact, it is present in more than 100 countries.

Citi Australia is also the largest international bank in the country, and through the years, it has provided a huge amount of financial services to Australian individual consumers, institutions, corporations, and governments by creating a perfect merger with local financial experts with the power of Citibank’s access to a global consumer banking network. Its range of services includes credit cards, mortgages, insurance, charge cards, deposit accounts, foreign currency deposits, and investments.

Citi is based in Sydney and has a major presence in Melbourne, Perth, Adelaide, and Brisbane. It has been recognized by the Federal Government’s Equal Opportunity for Women in the Work Place Agency as an ‘Employer of Choice for Women’, a great honor for them.

Citigroup is known the world over for a variety of innovative products. More than one million Australians trust Citibank for their financial needs, while more than a thousand institutional and corporate clients have been valued customers for years. Not many banking groups operating in Australia have the full range of services that it has, with the ability to tap capital and experts the world over.

There are two major divisions that operate in Citi Australia. The first division is Global Consumer Bank. Global Consumer Bank has unique, customer-centric products. Its industry-leading products and services and world-class digital channels are geared towards retail customers. The second division is the Institutional Clients Group. The Institutional Clients Group has three sub-divisions namely markets and securities services, treasury and trade services, and investment and corporate banking. They provide a comprehensive range of financing products and strategic advisory to local Australian corporations as well as multi-national corporations. We are one of the leading underwriters of debt and equity in Australia. Some of the commercial banking operations that are on offer are cash management, foreign exchange, custodial, and trade and treasury.

Citi is a big support of the entire Australian community, with its Citi Foundation grants, employee volunteer efforts, and fundraising.

Citi Australia Customer Service

Citi Australia’s Global Consumer Bank Division has the following services to their clients: banking, credit cards, loans, home loans, investments, insurance, Citi priority, Citigold, and Online Services.

Citibank offers its individual clients 6 accounts, with features that are tailor-fit to their needs: Citibank Plus Transaction Account, Citibank Online Saver, Ultimate Business Saver, Citibank Term Deposits, Citibank Ultimate Saver, and Cash Investment Account. Citibank Plus and Citibank Online Saver both have $0 minimum opening balance and monthly account keeping fee. The only difference is that the Citibank Online Saver is a high-interest online savings account. The Ultimate Business Saver, Citibank Ultimate Saver, and Citibank Term Deposits have a minimum opening balance of $10,000.00. The ultimate business saver is designed for business, trust, or DIY super fund. The Citibank Ultimate Saver is a flexible saving account with flexible access. Citibank term deposits let you earn competitive interest and guaranteed returns. The cash investment account is for holding on to cash that will eventually become a part of an investment portfolio or to is used as parking in-between investments. Citibank also offers Multi-currency term deposits, which is available in ten currencies: Euro, Canadian Dollar, Hong Kong Dollar, Japanese Yen, New Zealand Dollar, Pound Sterling, Singapore Dollar, South African Dollar, Swiss Franc, and the US Dollar.

Citibank also offers foreign currency accounts, designed to help individuals or businesses manage and transact using multiple currencies. There is an initial minimum investment that amounts to AUD $10,000 or equivalent. There are no up-front or monthly account keeping fees for foreign currency accounts, and clients can move between currencies in order to take advantage of favorable movements in the FOREX market.

Citi Australia offers 8 credit, each laden with features and benefits based on monthly income range. The following credit cards are on offer: Signature, Platinum, Classic, Citi Simplicity, Clear Platinum, Citi Prestige, Emirates Citi World, and the Citi Qantas Signature. Citi Simplicity has no annual fee, while Citi Clear Platinum has low-interest rates. Citi Rewards Program offers great ways for customers to enjoy their credit points.

The Global Banking and Investment division of Citibank is beneficial for individuals who are moving to another country. Since Citibank is present in about 160 countries around the world, managing global accounts is easier. Australians who live overseas can also open a global account so that they can manage various currencies, along with having an Australian dollar account. Customers are also able to invest globally.

The advantage of having a Global Account is that there is a Citibank allows the customer to have a global view of accounts, where they can see an overview of their account balances in all locations in the world. There is also access to a global network, with a presence in 24 countries, 20,000 ATMs, and 4,000 branches. Another feature of this account is the Global Transfer facility. Global Transfer is a practical way to send funds to customers’ checking, savings, or money market accounts to multiple countries. Another great benefit of having a global account is that Citigold customers can use their already-established credit card history to apply for a credit card in another country.

Citibank Australia also offers its customers online banking products, which includes online banking, mobile banking, mobile wallets, eStatements, Email and SMS alerts, and global transfers.

Citibank has three lending products that meet customers’ needs: the Citi Personal Loan Plus, Citi Ready Credit, and Citi Business Credit. Citi Personal Loan Plus has a low rate of 11.99% and has fixed monthly repayments for customer convenience. Clients may borrow from as low as AUD $5,000 to AUD $75,000. Customers can also choose from flexible terms of 3, 4, or 5 years. Citi Ready Credit has a standard variable rate of 19.99%.with a line of credit from AUD $5,000 to AUD $75,000. Citi Business Credit can be used for any business expense and can be accessed online, through a debit card, or checkbook.

Visit the Citibank branch near you to know more about their services. Here are the locations of Citibank branches nationwide:

| New South Wales | |

| Branch

Address |

Opening Hours |

| Sydney CBD

Park Street Ground Floor, Citigroup Centre 2 Park Street Sydney NSW 2000 |

Monday to Friday, 9:00 AM – 5:00 PM |

| Sydney CBD

Hunter Street Corner of Pitt and Hunter Streets Sydney NSW2000 |

|

| Chatswood

451 Victoria Avenue Chatswood NSW 2067 |

|

| Victoria | |

| Branch

Address |

Opening Hours |

| Melbourne CBD Ground Floor350 Collins StreetMelbourne VIC 3000 |

Monday to Friday, 9:00 AM – 5:00 PM |

| Queensland | |

| Branch

Address |

Opening Hours |

| Brisbane 141 Queen StreetBrisbane QLD 4000 |

Monday to Friday, 9:00 AM – 5:00 PM

(AEST 1 hour non-daylight savings time) |

| Western Australia | |

| Branch

Address |

Opening Hours |

| Perth Ground Floor37 St. Georges TerraceCorner Barrack StreetPerth WA 6000 |

Monday to Friday, 9:00 AM – 5:00 PM

(AEST 1 hour non-daylight savings time) |

Citi Australia Contact Number

With CitiPhone Banking, Citi gives its customers access and power to control own banking 24 hours a day, every day of the week. You can call anywhere, anytime. Call CitiPhone, and in order to gain access, customers need their Citi card number, Telephone Identification Number, and their registered mobile phone to receive One-Time PIN. Through the CitiPhone Banking facility, which is available 24/7, customers are able to access their deposit accounts, credit card information, and have the ability manipulate their accounts.

| Services | Contact Details |

| Citi Phone Banking | 13 24 84 |

| Global Banking for those moving to Australia | +65 6595 2255 Citibank APAC Global Support Centre |

| Accessibility services for customers with hearing and speech impairments (Telephone Typewriter users) | 133 677 ask for 02 8225 0615 |

| Accessibility services for customers with hearing and speech impairments (Speak and Listen users) | 1 300 555 727 ask for 02 8225 0615 |

| Accessibility services for customers with hearing and speech impairments (Translation and Interpreting Services) | 1800 131 450 |

| Hardship Assistance | 1 800 020 861 (fax)

1 800 722 879 (phone) |

Contact Citi Australia

Citi Australia encourages customers to send them written correspondence for queries and concerns. Here are relevant mailing addresses:

| General Concerns | Citi, GPO Box 40, Sydney NSW 2001 |

| Investments | Citibank – Skybranch, GPO Box 40, Sydney, NSW 2001 |

| Deposit accounts | Citibank, GPO Box 40, Sydney, NSW, 2001 |

| Home Loans | Citibank, GPO Box 4799, Sydney NSW 2001 |

| Collections – credit cards and loans | PO Box 3913, Sydney, NSW 2001 |

| Collections- Home Loans | PO Box 40, Sydney, NSW, 2001 |

| Insurance | |

| MetLife | GPO Box 3319, Sydney NSW 2001 |

| AIA Australia | PO Box 6111, St. Kilda Road Central, VIC 8008 |

| OnePath | 347 Kent Street, Sydney NSW 2001 |

| Cheques and Deposits | |

| Credit cards | GPO Box 5427 Sydney NSW 2001 |

| Deposits | Banking Services, Citibank Pty Ltd, GPO Box 40, Sydney, NSW, 2001 |

| Ready Credit | GPO Box 5427, Sydney, NSW, 2001 |

| Home Loans | GPO Box 5347, Sydney, NSW, 2001 |

| Hardship Assistance | PO Box 3453, Sydney, NSW 2001 |

Citibank Phone number and Support

Citibank provides their customers with the power to control their own banking from anywhere, at any time. You have the freedom to do your own banking 24 hours a day, seven days a week, where ever you are in the world at a time that suits you. For contacting Citibank Phone number, the local Australian persons can call 12 24 84 and customers from overseas can call 1800 020 861. For customers who are deaf or facing hearing/speaking impairment can also contact Citibank Phone number via National Relay Service at www.relayservice.com.au. And the official support page of Citibank Australia is https://www.citibank.com.au/. Via the Social media profiles on web, you can also leave message with any of your questions for unofficial customer support.

Citibank Australia has also mobile banking options via Citiphone Banking on their website and you need to provide your Citibank card number and Telephone Personal Identification Number (TPIN).

Contacting Citibank Phone number

You can contact Citibank Phone Number on or if you are overseas. Citibank online Banking is available 24 hours a day, seven days a week. Follow the easy directions to access information regarding your account. There is also an option to speak to a customer service officer if required to complete your inquiry. Also, there is email service, mailing service at (Citibank, GPO Box 40, Sydney NSW 2001), hardship assistance and directly visiting options for local visitors to Australia.

Rate Citibank Customer Service!

Tell people what you think. Help others by sharing your experience with Citibank

[modalsurvey id=”408059976″ style=”flat”]